Gold could be much more efficient than cash for storing wealth. Interest rates stay low, meaning your money in the bank 'earns practically nothing', CNN Money reports. When inflation is taken into account, that cash may have lost value. It is recognized that gold has a history of long-term stability.

Putting money in gold instead of in a savings account or even under the mattress could mean better returns, fewer risks and more peace of mind. Learn more by comparing the savings benefits of gold with those of cash. Saving money with gold gives you the security of a “savings account” and the potential for investment gains without the “risks” of investments. Here are 3 reasons why saving money with gold makes more sense than putting money in a savings account.

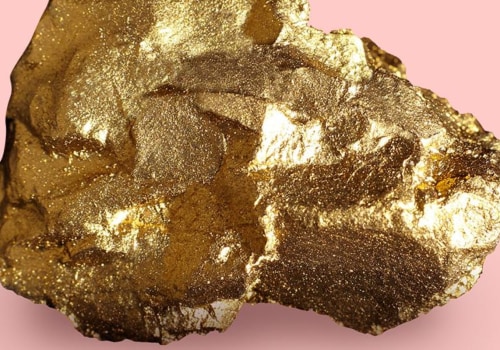

While saving money in foreign currency may not be the best option, saving money in gold definitely is. But what makes gold an incredible savings asset? First of all, by buying gold, you will consolidate your assets, something you should always aim for. Mostly because cash is worthless unless you have something to back it up, while gold will always hold its value. On top of that, if you decide to buy gold, you'll have something to pass on to your next generation, as many people around the world have done for centuries.

Every investment has advantages and disadvantages. If you object to owning physical gold, buying shares in a gold mining company may be a safer alternative. If you think gold could be a safe bet against inflation, investing in coins, bars or jewelry are paths you can take to gold-based prosperity. Lastly, if your primary interest is to use leverage to profit from rising gold prices, the futures market could be your answer, but keep in mind that there is a considerable amount of risk associated with any leverage-based holding.

In other words, even though the nominal value of a savings account increased from accrued interest income, the overall purchasing power of the money being saved was losing value. This means that the interest rates for depositing your money in a bank have been and remain very low, below 1% in most cases. In short, this act began to establish the idea that gold or gold coins were no longer needed to serve as money. If you want to save money, the general idea is to put money in a savings account, but I argue that putting money in a savings account isn't always the smartest way to save money.

This might also be the right time to mention that gold is considered the safest form of liquid money. Up 6.2% year-on-year, the biggest increase since November 1990, could be a good time to assess how you can save money by considering gold investments. The relatively solid money that had previously prevailed, when it was said that the “dollar was as good as gold,” gave way to a deplorable policy that ushered in decades of money degradation. Another reason it's smarter to save money with gold instead of putting money in a bank account is that gold is portable.

Whereas once the mantra of money management was “invest it and retire rich,” it is now “save it or lose it,” a healthy reaction to chaos, greed and the notable lack of security in traditional investments, including those sponsored by Wall Street financial firms. In other words, the coins that were used as money simply represented the gold (or silver) that was currently deposited in the bank. Grandpa mentioned that saving money is the first step in planting the seed, while smart investments are the last step in planting the seed. Gold in the form of SGB is therefore lucrative as an investment option than traditional forms of gold and can help you save while making an investment in gold.

However, the usefulness of these goals has not been diminished by modern money shocks, nor has the resulting monetary clutter changed the obvious need that everyone needs to plan and prepare for an uncertain future, so savings remain as important today as at any other time. from the past. which poses an obvious problem. When investors realize that their money is losing value, they will begin to position their investments in a strong asset that has traditionally held its value.

. .

Leave a Comment