Gold is a protection against inflation · 2.It maintains its value for a long period of time · 5.One of the factors that make gold a good investment is liquidity. Gold can be easily converted into cash when you want it. Compared to other investments, gold is the only investment that has high liquidity. There are many reasons to invest in gold, but there are also many disadvantages.

On the upside, gold is recognized as a safe haven investment, has low long-term volatility and is easy to understand. Negative aspects include potential transaction costs, storage problems and lack of liquidity. In addition, you can prefer any trusted and proven gold investment company as your Gold Investment Guide. In addition to many benefits of Gold Investments, it is worth mentioning the tax savings.

You do not have to pay more than 28% of income tax on collections held for more than one year. Not only is gold easy to convert into cash, but the return on investment in gold is also not affected. It is in demand, which means that gold has become a highly liquid investment that gives you the freedom to use the money invested in case of emergencies. This means that you have to pay a little more than your real market value.

The same is true if you intend to sell it. Liquidity is one of the biggest disadvantages of investing in gold when your goal is to maintain it for a shorter period. You may not be able to make a profit due to agent or dealer commission. An initiative of Kredent InfoEdge Pvt.

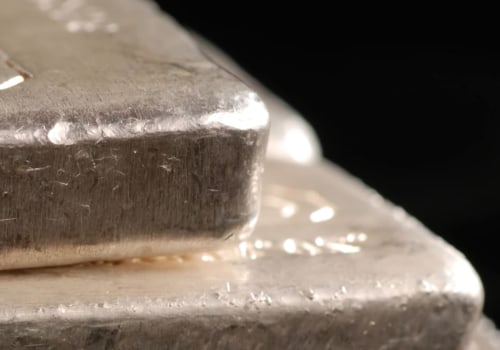

So, if you really want to maximize your profits, you'd better invest your money in indices or mutual funds instead of investing in gold. So, if you are planning your retirement or want to leave something for your children and grandchildren to have, you can invest in gold bars, coins or bonds. These investors have as many reasons to invest in metal as there are methods to make those investments. For example, if you invest in real estate, it will usually take weeks or even months to sell your property at a reasonable price and this can really get you into financial trouble in case you need money urgently and can't wait that long.

Investors can invest in gold through exchange-traded funds (ETFs), buy shares in gold miners and partner companies, and purchase a physical product. While you must have a decent knowledge about what you are doing if you invest in stocks or real estate, you don't need a high level of experience when it comes to investing in gold. It is clear that gold has historically served as an investment that can add a diversification component to your portfolio, regardless of whether you are concerned about inflation, a U. in decline.

Investors like to buy gold for a number of reasons, including the diversification it adds to an investment portfolio and the fact that it is often seen as a hedge against market instability. An investor can buy a bond, for example, because it generates value in the form of interest payments. During those times, investors who owned gold could successfully protect their wealth and, in some cases, even used the commodity to escape all the turmoil. Not only can you invest in physical gold bars, but investing in gold can also include investing in gold watches or gold art, which can also be considered a kind of status symbol and also looks pretty good at the same time.

If you don't invest in physical gold bars but in gold watches, you also have to fear that they will rob you in public and that sooner or later you will lose your treasures in this way. Even those investors focused primarily on growth rather than stable income can benefit from choosing gold stocks that demonstrate historically strong dividend yields. If you have planned to invest your savings in gold, it is worth recognizing the advantages and disadvantages of investing in gold. Growing trends in emerging economies, such as Indian China, are more likely to invest in gold as nations prosper.

.

Leave a Comment