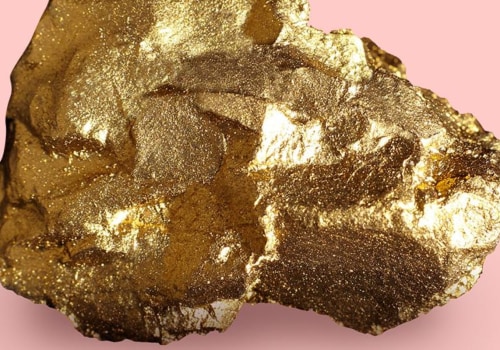

Gold tends to rise when other investments decline, providing a stabilizing effect for your portfolio. Gold is a protection against inflation. You don't have to pay capital gains tax until you sell. No one should know you have it if that matters to you.

Gold stocks attract growth investors more than income investors. These stocks usually rise and fall in sync with the price of gold. However, you can find well-managed mining companies that can make profits even when the price of gold falls. In general, gold is considered a diversifying investment.

It is clear that gold has historically served as an investment that can add a diversifying component to your portfolio, regardless of whether you are concerned about inflation, the fall of the US or US dollar, or even the protection of your assets. If your focus is simply diversification, gold is not correlated with stocks, bonds, and real estate. Imagine that if you have invested money in a property, you have to keep it in good order and this can be very exhausting if you are busy with your profession. You can even consult your financial advisor before starting your investment and choose a decent portfolio size for this investment.

This blog is not, nor should it be considered, as an investment advice or a recommendation regarding any particular security or course of action. When the economy is uncertain, people tend to invest more in gold, and this causes the price to rise even higher. On the contrary, the price of their gold would normally rise in such difficult times because more people turn to physical investment when they see that financial markets are not giving them bright hope. There are many benefits to choosing gold as an investment, as it is well known that it protects your investment in the long term.

You're not speculating on a numismatic currency that will one day get a higher premium than you paid; you're investing in gold bars to protect yourself from the crisis and protect yourself from a loss of purchasing power. You can buy rare gold coins, but this is the collector's world, which most investors should avoid. The time and skill it takes to create jewelry results in high prices; of which they are not always the best investment for those seeking exposure to pure gold. For example, demand for gold in China has remained stable, as many investors prefer gold bars as another type of savings.

During those times, investors who owned gold could successfully protect their wealth and, in some cases, even used the commodity to escape all the turmoil. When it comes to investing, there is one thing you need to understand, as it can wipe out your investment in the long run. No major economic depression or stock market crash will put your investments to zero; gold will likely continue to stand after the smoke clears. In this way, if one diminishes in value, there is a possibility that the other investments will compensate for the decrease.

SPRD trades only in bullion, allowing investors to see the price movement of the precious metal without considering other factors. With this factor in mind, avoid investing in cash, as its value will only depreciate, especially in a growing economy.

Leave a Comment