Gold is a protection against inflation · 2.It maintains its value for a long period of time · 5.One of the factors that make gold a good investment is liquidity. Gold can be easily converted into cash when you want it. Compared to other investments, gold is the only investment that has high liquidity. In addition, you can prefer any trusted and proven gold investment company as your Gold Investment Guide.

Along with many benefits of Gold Investments, it is worth mentioning tax savings. You do not have to pay more than 28% of income tax on collections held for more than one year. Not only is gold easy to convert into cash, but the return on investment in gold is not affected either. It is in demand, which means that gold has become a highly liquid investment that gives you the freedom to use the money invested in case of emergencies.

This means that you have to pay a little more than your real market value. The same is true if you intend to sell it. Liquidity is one of the biggest disadvantages of investing in gold when your goal is to maintain it for a shorter period of time. You may not be able to make a profit due to agent or dealer commission.

When you decide to buy gold, you will pay a premium that is closer to the current market price. The premium will affect you in such a way that when the value of gold falls, you will have losses. The losses you receive will be equal to the current value of gold. Whenever you sell your gold and make a profit, you will have to pay a tax.

Current IRS rates are 28%, which is the maximum. There are many reasons to invest in gold, but there are also a lot of disadvantages. On the positive side, gold is recognized as a safe haven investment, has low long-term volatility and is easy to understand. Negative aspects include potential transaction costs, storage problems and lack of liquidity.

But this gold standard didn't last forever. During the 1900s, there were several key events that eventually led to gold's transition out of the monetary system. In 1913, the Federal Reserve was created and began issuing promissory notes (the current version of our paper money) that could be exchanged into gold on demand. The Gold Reserve Act of 1934 granted the U.S.

Government title to all gold coins in circulation and end the minting of any new gold coins. In short, this act began to establish the idea that gold or gold coins were no longer needed to serve as money. It dropped out of the gold standard in 1971, when its currency stopped being backed by gold. In general, gold is considered a diversifying investment.

It is clear that gold has historically served as an investment that can add a diversifying component to its portfolio, regardless of whether it is concerned about inflation, a fall in the US. UU. Dollar, or even protect your assets. If your focus is simply diversification, gold is not correlated with stocks, bonds, and real estate.

To determine the investment merits of gold, let's compare its return to last year's S%26P 500 (as of March 2021). Gold outperformed S%26P 500 during this period, with the S%26P index generating around 10.4% in total returns compared to gold, which yielded 18.9% over the same period. Investors can invest in gold through exchange-traded funds (ETFs), buy shares in gold miners and partner companies, and purchase a physical product. Compared to other commodities, it is easier for ordinary investors to get gold, as people can easily buy gold bars from precious metal traders or, in some cases, from banks or brokerage firms.

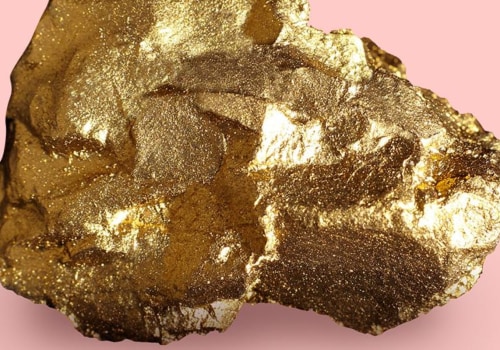

However, gold, paper, bar or coin funds are tangible, which means that investing in gold benefits you in many ways. Investing in gold is a risky business, as finding a reliable gold investment company is a tough nut to crack. Another reason not to buy gold is that you can also be scammed and buy fake gold from dubious sellers. The creation of a gold coin stamped with a stamp seemed to be the answer, since gold jewelry was already widely accepted and recognized in various corners of the earth.

If you're interested in adding gold to your arsenal, you can't go to the bank and start buying gold bars. With gold futures, you only need to pay a fraction of the total price and you can have a large amount of gold cheaply. For gold futures, you agree to buy gold from the seller at the agreed price on a specific date in the future under a financial contract. Instead, your fund's shares give you access to gold, whether it's physical gold, gold futures or gold corporations.

Millions of gold traders around the world are just waiting for one buyer to sell them their gold. Also, when you buy physical gold from a dealer or gold investment firm, they have their share in it. . .

Leave a Comment